- By Kyle Wolf

- Posted Tuesday, July 10, 2018

FY 2018 – 2019 Adopted Budget

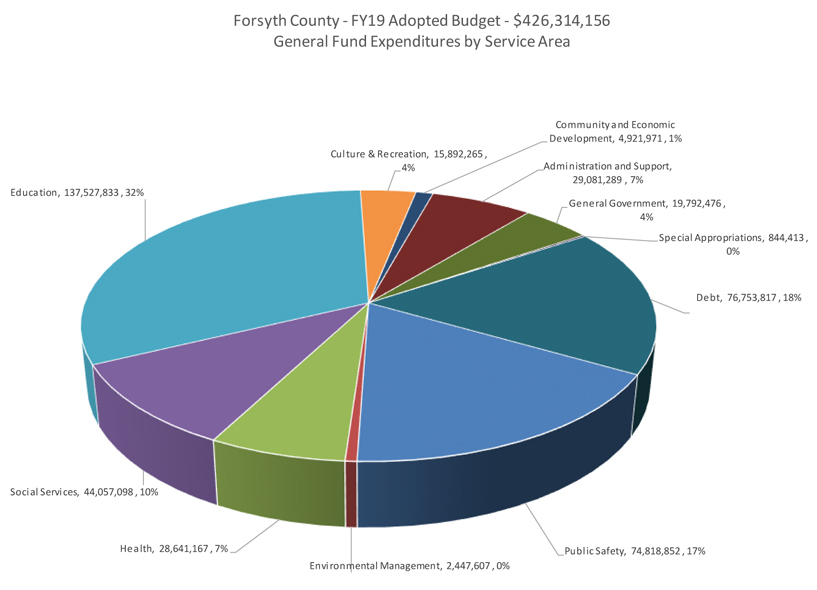

The Forsyth County Board of Commissioners adopted the county's budget for Fiscal Year 2019 on June 7, 2018. The adopted budget includes $426,314,156 to fund County operations.

The adopted budget for FY 2019 maintains the current tax rate of 72.35 cents. This tax rate includes 4.51 cents that is dedicated to two Education Debt Leveling Plans as well as 0.57 cents for the Library Debt Leveling Plan and 2.9 cents for the 2016 Public Improvement Bonds Debt Leveling Plan.

A driver of the Recommended FY 2019 Budget that was presented to the Board of Commissioners was a 2.3 cent tax increase to create a Court Facilities Debt Leveling Plan. The Board of Commissioners decided to give voters a choice on how to pay for this debt service and did not include this tax increase. Voters will have the option to pass a sales tax increase in November 2018 that is projected to generate enough revenue to pay for the Court Facilities debt service or have a property tax increase in FY 2020.

In addition to the property tax, Fire Tax District rates were also set for FY 2019. Each Fire Tax District rate was increased .36 cents to fund additional positions for County-provided fire suppression to the volunteer fire departments in each district. Horneytown and Piney Grove received an additional increase in their fire tax district rate.

The chart below details the expenditures by service area within the FY 2019 adopted budget.

The adopted budget will be available in its entirety on the Adopted Annual Budgets page of the Budget and Management website. A hard copy of the Adopted Budget is also located in the Budget and Management Office on the 5th floor of the Forsyth County Government Center.